Dacris MarketRisk FAQ

View Slideshow | View Teaser Video | Screenshots | Community | Order Now

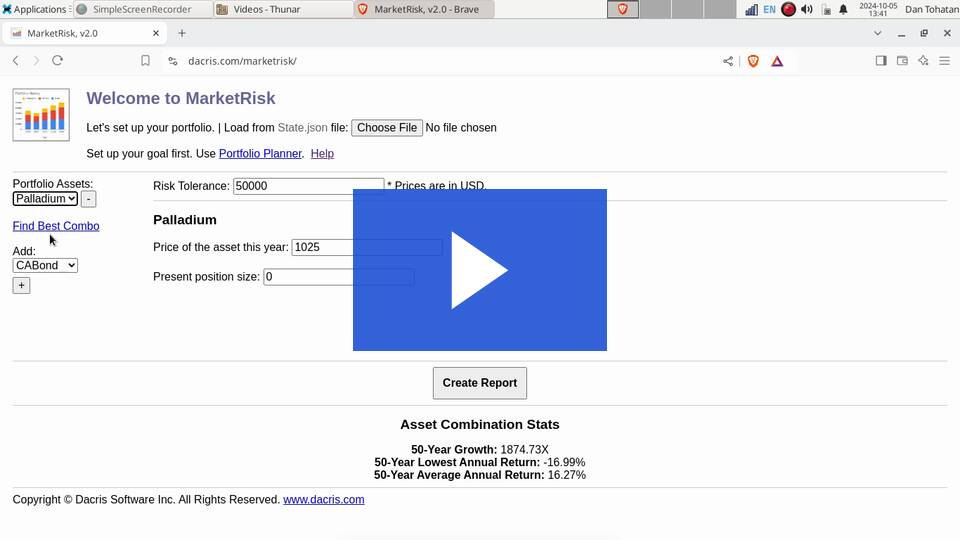

Free Online Demo of MarketRisk Web

Only 50 subscriptions will ever be sold!

What is wrong with traditional investing and why do you need MarketRisk?

Traditional investing disadvantages: 1) Unknown risk - The classic low/medium/high risk scale is too vague 2) Unknown performance - You don't have the history of the last 50 years visible 3) High fees - Traditional mutual funds or managed funds charge very high fees (2%) which can add up to 50% over 30 years 4) Low returns - Most investments have returns lower than the S&P 500 5) Poor rebalancing - Traditional portfolio rebalancing is imprecise and doesn't scale well to more than 2 assets MarketRisk addressed all of the above disadvantages. For me, MarketRisk helped me create a diversified portfolio of low-fee ETFs with an annual return over 16% from 1970-2020. As a result, I was able to become financially independent on a portfolio 2.4X smaller than traditional portfolios. For most people, the portfolio has to be over $1 million (traditionally). With MarketRisk, it can be less than $500,000. This is the very definition of "less is more." I came from a background where I didn't have a lot of money available. Making money was a challenge, and saving money was even more challenging. I eventually was able to create a saving habit, but it seemed like it would take me over 12 years to reach financial independence. MarketRisk shortened that time in half. I got back 6 years of my time by investing 1 year part-time in developing and researching MarketRisk. But... You don't have to spend a year of your time researching and developing an investment strategy. MarketRisk can save you most of that time, plus half the time to build a conventional portfolio. It can provide you with information on what to invest in, which ETFs, and how much. Its Portfolio Planner feature can guide you to your goal.

What is MarketRisk and Risk-Centric Investing?

MarketRisk is an online portfolio management app that can be used for risk-centric investing. Risk-centric investing is an investing technique that focuses on keeping risk constant and limited throughout your investing journey.

"MarketRisk is my map for navigating the markets. I can see which assets are overvalued / undervalued, and instantly determine how much I should invest."

- Dan Tohatan

Risk is defined as the maximum one-year potential decline in your portfolio's value, throughout your portfolio's history. Risk often occurs due to overvaluation, i.e. when an asset price is way above its historical average. Risk is reduced when an asset is undervalued, i.e. its price is way below its historical average. In a way, risk-centric investing is similar to value investing, in that it seeks to maximize investment into undervalued assets.

Depending on how quickly you grow your risk tolerance, you can use MarketRisk for growth investing, blend, or income investing. For example, if your risk tolerance only grows by the inflation rate, you are doing income investing. In income investing, most of your portfolio's gains are realized immediately and turned into income. If your risk tolerance grows by a large amount, say 8% in real terms per year, you are doing growth investing. In growth investing, most of your portfolio's gains are reinvested and grown over time, not realized immediately. There are advantages and disadvantages to every investing technique. The beauty of risk-centric investing is that you know how much you are risking, so in theory your money is safer over time.

How can I use MarketRisk for financial planning?

Run MarketRisk once a year, at the start of the year, to figure out your annual asset allocation for your portfolio. You can use MarketRisk's HTML report to make decisions about what to buy, which ETFs, and how much. While MarketRisk is not intended to fully replace your financial advisor, its portfolio manager can provide unique insights and research, including backtesting for its automated investing strategy. MarketRisk does not provide tax advice, however, so you would still need an advisor to get a plan that fits your needs. However, MarketRisk can provide higher average returns over long periods of time, thanks to its risk-centric algorithm.

How do I order?

Note: Only 50 subscriptions will ever be sold. We reserve the right to reject sales at our own discretion. Please write and mail a cheque for the total amount of the one-year subscription to: Dacris Software Inc 22 Ferris Street Richmond Hill, Ontario Canada L4B 4K6 You will receive a license key by email 24 hours after we have deposited your payment. Pricing Structure After 11:59pm UTC September 26th, 2025: $59/month subscription (1-year billing cycle) + 0.6% of assets under management. Amount owed for assets under management will be due at the end of each 12-month period that MarketRisk is used. Subscription amount for 1 year will have to be paid at the start of the subscription.

I have a question. How do I reach you?

Please fill out the form below.

What are the advantages of using MarketRisk?

- You know your risk (in $)

- You can limit your risk to a specific amount

- By investing in low-risk assets more, you get higher returns with less volatility

- By investing in the low-fee ETFs recommended by MarketRisk, you avoid losing up to 40% of your investment to high fees

- You stick to a discipline that is automated and back-tested over at least 50 years

- You avoid the high-risk assets out there, like crypto, which can result in 100% loss

Ask yourself, "How much would I pay for an additional potential 110% return (or more) over 15 years on my investments, and the ability to limit my risk?" How about... less than $200?

What are the assets it supports?

MarketRisk supports 9 investable assets presently:

bonds (US, CA), Dow, S&P 500, S&P/TSX Composite, gold, silver, platinum, and palladium.

What does it recommend?

MarketRisk calculates the valuation risk in each asset in your portfolio, and recommends a position size for the asset in US $.

What is the best performance it can achieve?

A return of 2743X from 1970 to 2020, or an annualized rate of return of 17.16% averaged over 50 years.

Mean variance of the rate of return is +/-1.5% over all rolling 50-year periods starting in 1949 and ending in 1970.

Asset Combination: Dow, gold, palladium.

Note: Past performance is no guarantee of future results.

How does that compare to equal-weight allocation?

For the same combination (Dow, gold, palladium), annual return is 65% greater, with 30% less risk, by using MarketRisk's allocation algorithm versus equal-weight $ allocation.

What results can I expect?

Although we do not guarantee any particular result, we are confident that by applying the algorithm we developed, you will get an up to 5% higher annual return on your portfolio with 3 or more assets versus an equal weight allocation, averaged over a period of 15+ years.

In addition to that, we claim that your downside over 1 year will always (99% of years) be limited to what the program calculates as "amount risked", which is limited to your own maximum risk tolerance.

"There is no panacea in investing. There is only discipline. And if you are disciplined, the best you can hope for is slightly more than the average market return - 10%. Even the best investors out there do not get more than 15-20% over the long term. You can spend all your waking hours analyzing the market and still not have much of an edge. I created MarketRisk for peace of mind in investing, as a result of 2 years of research. It is not for everyone, but its thesis is central to value investing: risk must always be considered first, and be limited."

- Dan Tohatan

How does it work?

First, we must calculate risk for each asset. This is calculated by looking at the ratio of price to money supply, in relation to the average ratio of price to money supply since 1929. The risk is then proportional to the ratio between current price / money supply and average price / money supply. Risk is defined as the maximum 1-year loss relative to an expected rate of return of 15.5%. If we can lose 4% in a year, the risk is 19.5%. Because this is a maximum, it is intended not to occur, within at least 100 years.

Next, we must calculate position sizes recommended for asset allocation for the portfolio. For this, we allocate more to the lower risk positions and less to the higher risk positions. The end result is that the total risk must be conserved. That is, the total risk of all positions must be equal to your own risk tolerance. This way, we preserve the primary premise: total portfolio risk is limited to your maximum risk tolerance.

MarketRisk has many layers of built-in discipline, from multiple margins of safety of at least 20%, to allowing only 10-15% at a time to be bought per year (for dollar cost averaging), to allowing only up to 20% of a position to be sold in a given year. Take advantage of these smart algorithms to build some discipline into your investing strategy.

What influenced the thinking behind MarketRisk?

The idea came to me as I studied investing and how we make investment decisions. Without knowing about Seth Klarman, I came up with the hypothesis that risk should be considered first in investing, without even looking at returns. This turned out to be right after rigorous back-testing. But the idea coincided with a book review video I saw of "Margin of Safety" by Seth Klarman. Until then, no one had explained to me what process great investors use to achieve the results they do. When I learned about Seth Klarman's risk-first approach, it all made sense for me. We should always allocate according to risk. Valuation primarily determines risk. So that is when I realized that M2 money supply could be used as a guideline for average valuation of large-cap long-history securities. In my analysis of market prices going back to 1929, I detected a pattern - that prices tended to vary over the long term in line with money supply growth.

Read: "Valuation is Risk" by Dan Tohatan (PDF)

Can I use MarketRisk to make trading decisions?

MarketRisk is not a trading app. It helps you make long-term investment decisions. Portfolio adjustment happens once per year with MarketRisk. It is not intended to be used for short-term trading. If you are trading, there are other tools out there that you can use.

Can my computer system run MarketRisk?

MarketRisk is now a fully-hosted online application, so any Chrome-compatible web browser will be able to run it.